- Search

- Integrations

- Contact Us

- Log In

- Marketing

CMO

Unite your revenue team and drive strategy across the business.

Demand Gen

Focus on in-market accounts and take the guesswork out of demand gen.

Digital

Reach the people and accounts that matter to your business.

How We Do It

Account Identification

Accurately match anonymous and known buyer behavior to accounts.

Intent Data

Uncover 3rd party buying signals at the keyword or topic level.

Predictive Analytics

AI-driven buying stage predictions align teams on the best time to engage.

Data Enrichment

Enrich accounts, leads, and contacts with accurate firmographic data.

Smart Form Fill

Autofill and shorten forms with automated, real-time form enrichment.

Audience Building

Create audiences for segmentation, activation, and analysis across channels.

Advertising

Reach target buyers with display, video, retargeting, and social ad campaigns.

Conversational Email

Leverage AI to craft personalized emails that qualify & convert accounts at scale.

Orchestrations & Workflows

Scale data operations with accurate engagement of accounts and contacts.

Create Your Very Own AI Email Assistant

Use AI to craft relevant, on-brand email campaigns that compel conversations and get more meetings booked. - Sales

CRO

6sense gives sales leaders the intel they need to deliver on big revenue goals.

Inside Sales

When working hundreds of accounts, knowing where to prioritize is critical.

RevOps

Use clean, complete data and scalable processes.

How We Do It

Contact & Company Data

B2B contact data and account & buyer insights to engage prospects.

Account Intelligence

Arm reps with account insights in CRM & SEP for prioritization and personalization.

Prioritization Dashboards

Dashboards that help sellers uncover which accounts to engage and when.

Chrome Extension

Access Revenue AI insights directly from LinkedIn and other B2B websites.

Predictive Analytics

AI-driven buying stage predictions align teams on the best time to engage.

Buyer Intent Data

Uncover 3rd party buying signals at the keyword or topic level.

Prospecting Workflows

The insights sellers need in the tools they use, everyday.

Access FREE credits to unlock relevant contact info, and see our packages for teams of all sizes. - Solutions

Industries

Business Services

Drive efficiency with a data-driven approach.

Financial Services

Acquire loyal customers with rich secure data.

Manufacturing

Modernize revenue creation with AI-driven data.

Technology & Software

Drive growth and boost customer adoption.

Transportation & Logistics

Boost conversions with targeted audiences.

Data

Our Data

6sense delivers a complete dataset for B2B – including contact data.

Data APIs

Real-time enrichment and personalization anywhere.

Data Packs

Reduce manual processes to achieve database connectivity.

Ecosystem

Integrations

Explore our powerful integrations with leading technologies.

Become a Partner

Let's do more than just work together – let's revolutionize B2B.

Agency Partners

Need some help? Get support from our partners.

Dive into 6sense Revenue AI™

Reinvent the way your team creates, manages, and converts pipeline to revenue.

- Resources

Resource Library

Dive into various topics and content types.

Blog

Short insights, designed to educate.

In-Market Demand Report

Know which companies are interested in you.

Guides

Follow our in-depth articles & how-to’s.

6sense for 6sense

See how the 6sense team uses 6sense.

Revenue Makers Podcast

Steal playbooks from industry-leading brands.

6sense Named a Leader in Gartner Magic Quadrant for ABM for the 3rd Year in a Row

No email required to get a copy of this objective evaluation of the ABM vendors.

- Customers

Meet Our Customers

See how companies like yours leverage 6sense to drive efficiency.

Customer Stories

Dive into the success and journeys of our customers .

Customer Reviews

Read real reviews to understand what 6sense can do for you.

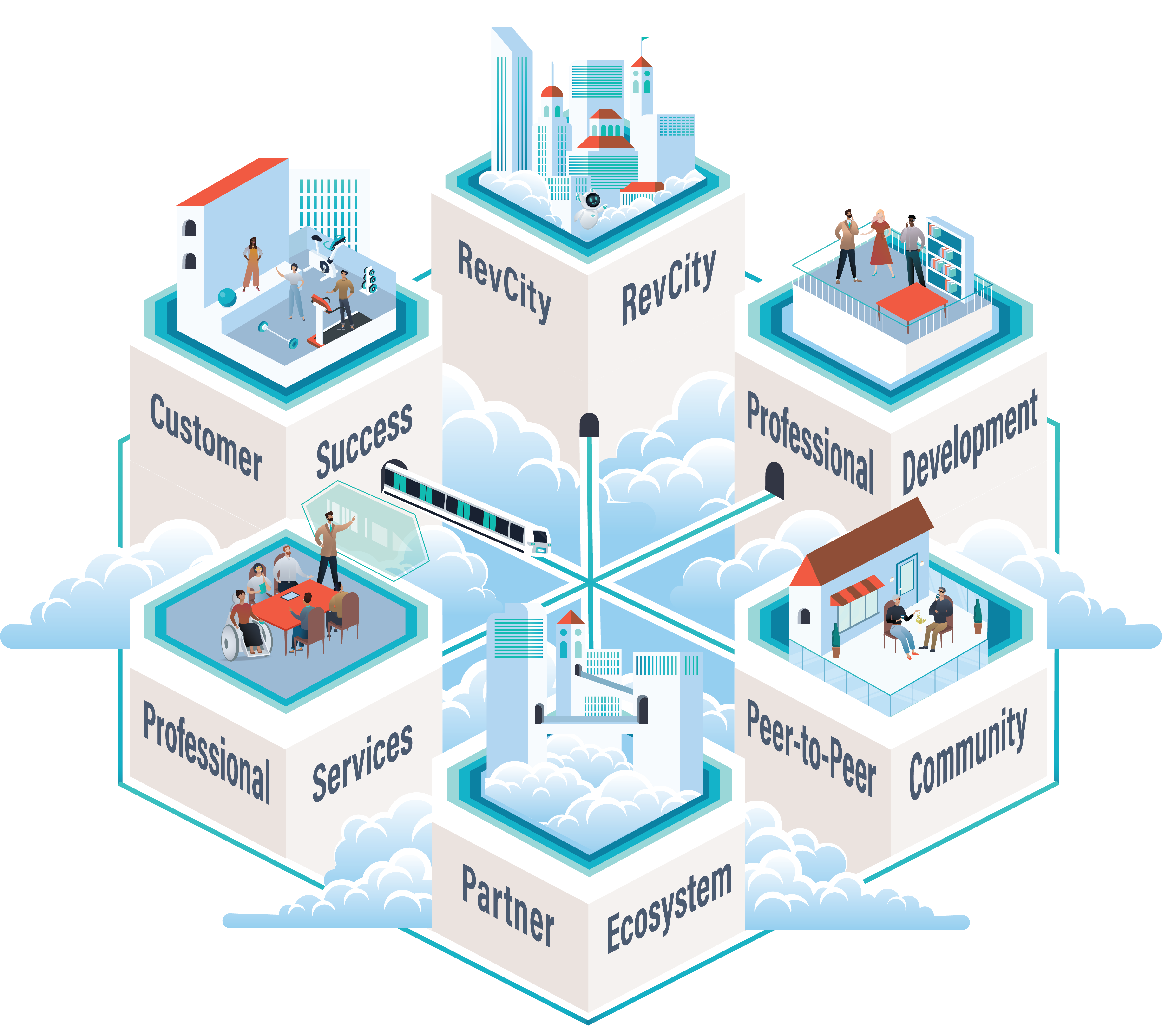

RevCity

Connect with your peers, share successes, and learn about 6sense.

Knowledge Base & Support

Explore our help articles, product updates, and submit support tickets.

WE GET YOU. WE GOT YOU.

Introducing the 6dimensional Success Model™ – a methodology that empowers customers to unleash their full revenue potential and and achieve extraordinary outcomes.

- Company

About 6sense

Learn about our company values, vision, employee benefits, and more.

Leadership Team

Dreamers and data nerds; Meet the leadership team behind 6sense.

Careers

We want 6sense to be the best chapter of your career.

Newsroom

Read press releases, thought leadership, company announcements and more.

Community

Dive into the communities 6sense hosts and takes part in.

Become Our Partner

Let’s do more than work together. Let’s revolutionize B2B together.