FinServ spends nearly $20 billion a year on online advertising — more than almost any other industry.

Given this massive level of investment, these organizations are also seeking ways to ensure strong ROI. For B2B revenue growth, they are turning to a technology-powered account-based strategy that helps them spot potential customers earlier and target those customers with more specific — and effective — messaging.

There are three core concepts that come into play with this approach:

- Intent data, which are buying signals that are generated as companies conduct research online. These signals can be captured and analyzed to identify which companies are considering a new business relationship.

- Segmentation, which involves grouping potential customers into audiences that have similar characteristics and interests. These audience segments can then be used to enroll customers in campaigns targeted to their needs.

- Personalization, aka delivering content tailored to your audience not only through marketing campaigns, but also through other touchpoints like your website and chatbots.

In this post, we’ll share how 6sense can provide expert digital marketing services for banks. In addition, we’ll explore how various financial services businesses can use the aforementioned ABM & B2B marketing concepts to transform their Go-to-Market strategies.

How Bulge Bracket Banks Can Boost Upsells and Cross-sells

Large, multinational banks typically have a team of relationship managers handling 30 to 40 accounts each. These managers must must know the buyers within each account on a deeper level in order to provide personal and meaningful engagement for both existing and potential customers.

To support this high-touch process, bulge banks must be able to sift through accounts and identify opportunities for expanding and cross-selling, as well as acquiring new business.

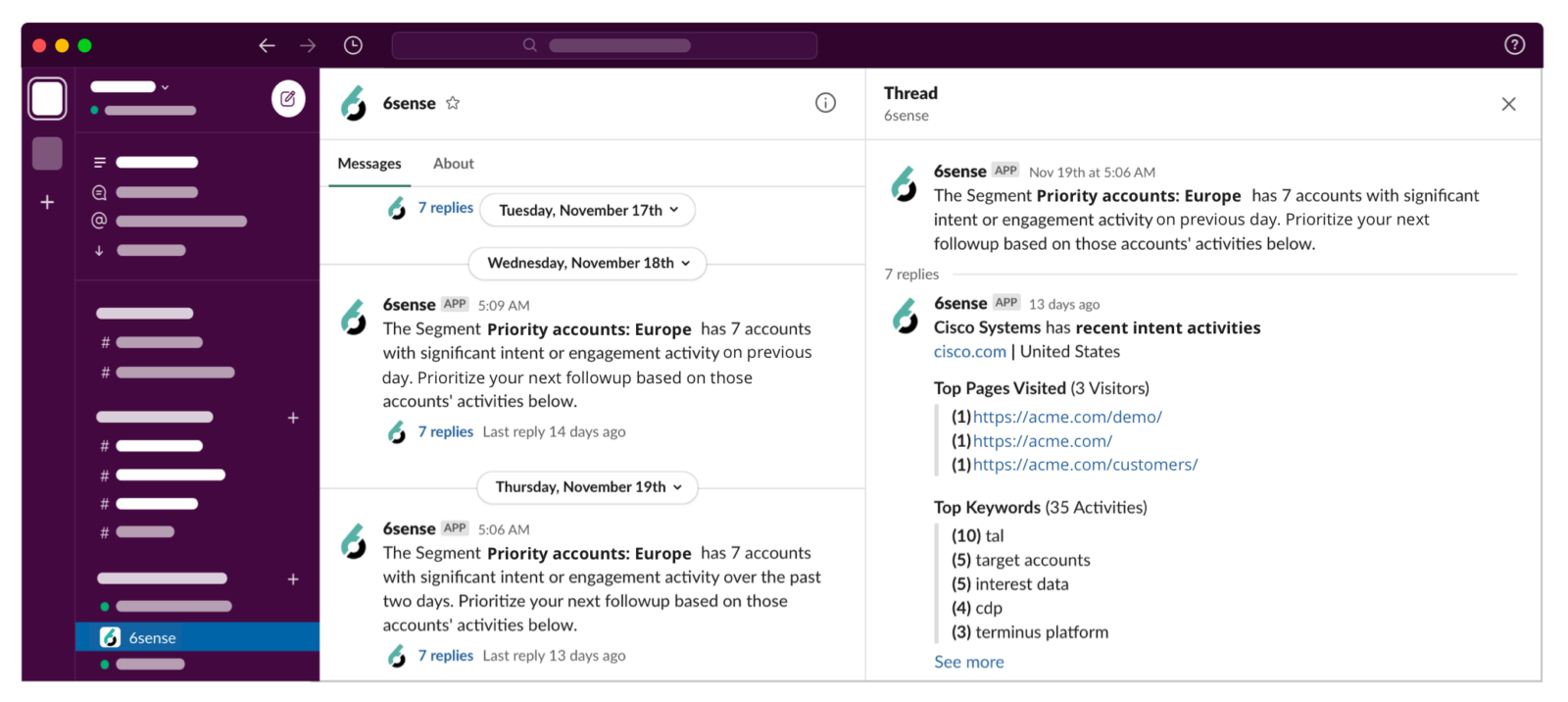

Intent data is a key advantage. With an account intelligence platform, reps can set relevant keywords and receive alerts when a buyer within one of their accounts is actively researching a service the bank can provide.

Here are a few keyword examples:

- Risk management

- Fraud prevention

- Business bank

- Wealth management

When you know what your buyers are looking for, it’s much easier to reach out to them — through marketing or direct outreach — with content and offers that are useful and likely to lead to deals.

How Regional Banks Spot Businesses That Are Shopping for B2B Services

Regional banks serve small to mid-sized businesses across just a few states, yet still compete with larger national financial organizations. One of their competitive advantages is proximity to the customers they serve. But one of their big challenges is competing for brand awareness against much larger organizations.

Segmentation allows banks to offer more personalized experiences to different types of clients. A commercial real estate developer has very different lending needs than a local pizza shop owner. Segmentation allows you to divide customers up by industry or firm size and deliver more appropriate marketing messages.

Account managers can also track intent data, keeping an eye out for businesses that are researching keywords such as:

- Business checking account

- Small business bank

- Commercial loans

- Real estate loans

For keywords attached to big-ticket opportunities — like “commercial land development loan” — you may decide to reach out directly to the customer.

For keywords being searched by hundreds of newly formed small businesses — like “business checking account” — you may decide to enroll the customer in a personalized marketing campaign tailored to the keywords they are researching and other services you can provide new businesses.

Business Insurance Providers

Different sized businesses are eligible for different kinds of coverage. For example, small businesses may be prime customers for a Business Owner Policy. This combined coverage covers general liability and business interruption, and also protects against loss of equipment and inventory. But it’s typically only available to businesses with less than 100 employees and $5 million in revenue.

Insurers can use an account intelligence platform to watch for new businesses that meet this criteria and add them to a list of target accounts.

They can then hone in on the best sales opportunities by using the platform to listen for accounts researching keywords such as:

- General liability insurance

- Business income insurance

- Professional liability insurance

- Cyber insurance

Conclusion

We all want the same thing: to contact the accounts looking for our services and deliver the content and outreach that gets them engaged. And the best way to get there? Finding accounts that are actively researching solutions and reaching them based on what we know they are interested in.

Regardless of company size, location, and target customer, any financial service organization can benefit from the robust data, segmentation, and personalization that an account-based marketing strategy and solution can provide.

Learn more about how 6sense intent data can elevate your customer engagement, expanding existing business and accelerating new growth.